epf contribution after 60 years of age

Whereas for the other 3 voluntary EPF contribution schemes theres an age-limit. EPFO wants wage headcount limits to be removed.

Epf Employee Provident Fund Calculation Withdrawal Rules Interest Rate Youtube

November 11 2019 at 233 pm.

. Age 5560 Incapacitation. As for EPF savings if members do not switch to Simpanan Shariah the savings will include dividends earned from non-Shariah compliant haram investment. If your age is between 50 to 58 years and you have served more than 10 years at a company then you can claim for the early pension.

I have been working since the age of 20 and have changed jobs thrice. The new minimum statutory rates will start. In the previous years the statutory employee contribution rate was set at 11 for EPF members under the age of 60.

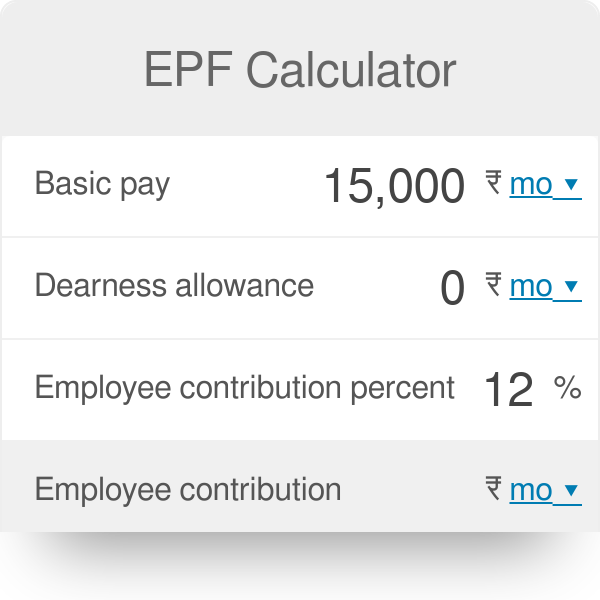

The money must go directly to EPF to boost savings and over 10 years. The employer and employee contribute 12 of the employees basic salary and DA towards the EPF scheme. At age 60 all the savings accumulated in Akaun 55 and Akaun Emas will be consolidated for withdrawal.

Withdrawals from the EPF account According to the EPF Act for claiming final EPF settlement one has to retire from service after attaining 55 years of age. Employee EPF Contribution. In case you defer the pension for 2 years until you reach the age of 60 years you will be eligible to receive the pension at an additional rate of 4 per year.

I am 66. NRIs need to deposit at least 500 upon enrolment 500 per subsequent contribution and 6000 every year. The pension fund means that amount onwhich the deptt did not give interest and provided pension after the services of 10 cont.

KUALA LUMPUR 7 January 2019. Retirement Schemes CPF Minimum Sum. As of now the EPF interest rate is 850 FY 2019-20.

The Employees Provident Fund EPF announces that the minimum Employers share of EPF statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four 4 per cent per month while the Employees share of contribution rate will be zero per cent. This is your contribution towards your EPF corpus. You cant even take a loan against them.

My monthly PF contribution is continuing since my first job and even now I am contributing to PF. EPF contribution rate for the newly recruited female employees has been reduced from 12 to 8. Iam on extension after age 60.

If the employee leaves the job between 50 to 57 years then he can avail the benefit of early reduced pension. The upper investment limit is Rs 15 lakh and one may open more than one account. It does not mention the age-limit for EPF Self Contribution.

Excess contribution that has been made by the employer Rs208250 -. 90 can be withdrawn at the age of 57 years. Withdrawal of PF balance only and full pension after the age of.

The loan has to come with rules such as those taking it cannot make a withdrawal at 55 but only when they reach 60. Employees contribution towards EPF 12 of Rs25000. About Age 60 Withdrawal.

Currently there is a mandatory wage ceiling of 15000 for employees and only enterprises with 20 or more workers can join its schemes including the flagship Employees Provident Fund EPF scheme which has over 55. This withdrawal is an extension of the Age 55 Withdrawal and caters for those who have opted for later retirement and continue working after 55 years old. You can withdraw 75 of your EPF after one month of unemployment.

All you must do is fill the Composite Claim Form and 10D. They can make contributions only via NRO or NRE accounts. I recently completed 45 years of active service and continue to work for a private company on a full-time basis.

A person who is a member of PF. SCSS can be availed from a post office or a bank by anyone above 60. Depending on the contract other events such as terminal illness or critical illness can.

But this rate is revised every year. You can withdraw 100 money from the EPF and EPS account at the time of retirement 58 years of age. Post 1971 has to be a member of Family Pension Scheme FPS automaticlly and continues to be a member of Employees Pension Fund EPF from 1995 even when he changes his job to an organization which is covered under PF Act.

As per latest EPF rules the employee contribution is 12 of Basic Pay Dearness Allowance. Between 70 and 80 it is five years and for those above 80 it is only four years. The employees CPF contribution is 20 up to age 55 above 55 to 60 years of age 13 above 60 to 65 to 75 and decreases to 5 for those 65 and above.

Can I ask company to deduct PF only continue as usual. More than 10 years of service. This will be available to the new female employees for the first 3 years of employment.

Top-Up EPF savings Toppeerecipient below 55 years of age. Only NRIs aged between 18 and 60 years and complying with KYC norms can enrol themselves under this scheme. The CPF Minimum Sum MS Scheme requires all members to set aside a minimum sum of CPF savings in the RA for retirement needs upon reaching 55 years old.

The 12 contribution made by the employer is split in the below-mentioned. The FPS was replaced with EPF I think some where in Sept or Nov. Pension is received after 58 years of age.

SCSS has a five-year tenure which can be further extended by three years once the scheme matures. For those between 60 and 70 it is six years. So next in January 2021 EPF members will contribute.

So next in January 2021 EPF members will contribute. Note that if you are an OCI or a PIO this scheme is not valid for. In the previous years the statutory employee contribution rate was set at 11 for EPF members under the age of 60.

As the name suggests only senior citizens or early retirees can invest in this scheme. Then this year in February 2020 this rate was lowered to 7 for the period from April 1 to December 31 2020 as part of the Economic Stimulus Package. Withdrawal of only PF balance and reduced pension age 50-58.

Years and after the age of 58cont8335 provident fund menas 12 of worker and 367 of emloyer on which deptt provide intt. The formula for calculation of pension amount is Pension Pensionable Salary Average of last 60 months X Pensionable Service 70. It is seven years for regular investors below 60.

A member is eligible for pension on retirement at the age of 58 years. Similar to EPF SOCSO contribution will be deducted from both employees and employers funds and will be paid every 15th of each month. Other than that the amount can be withdrawn only in the case of emergencies such as Medical emergency House loan repayment.

Now 95 thnaks kk advocate 21st March 2011 From India New Delhi. Bonds are not tradeable or transferable. I-Saraan below 55 years of age 2.

Malaysias 2021 budget announcement has highlighted that the EPF rate for employee under the age 60 years old is reduced from 11 to 6 by default with effect from February 2021 to January 2022. Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder. After 58 years of age or if unemployed for 60 days or longer.

I-Suri below 60 years of age 3. Contributions for a particular month will be eligible for dividend based on the last day of the contribution month until 31 December 2021. The bonds have a lock-in period which depends on the age of the bondholder.

The total EPF balance includes the employees contribution and that of. Then this year in February 2020 this rate was lowered to 7 for the period from April 1 to December 31 2020 as part of the Economic Stimulus Package.

Epf Account Pension Benefit Rules That Epfo Members May Consider Mint

Benefits Of Investing In Epf Niyo

Employee Provident Fund Epf Is Not Tax Free Anymore 60 Of Epf Withdrawals Will Be Taxed As Income Nri Sav Investment Tips Savings And Investment Tax Free

Epf Tax In Budget 2016 60 Pct Tax On Accrued Interest Only After April 1 2016 Budgeting Tax 60

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

How Epf Changes Over The Years Impact Your Retirement Funds

Epf Calculator Employees Provident Fund

Malaysia Keeps Epf Employee Contribution Rate Below 11 Pensions Investments

Can I Keep My Epf Account Operational And Earn Interest Post Retirement Mint

How Much Can We Withdraw From A Employee Provident Fund Epf During This Crisis Quora

Employee Provident Fund A Complete Guide

How To Increase Epf Contributions For An Employee And Employer In Deskera People

Lost Your Job Or Planning To Quit Here S How You Can Benefit From Your Epf

Basics Of Employee Provident Fund Epf Eds Edlis Gst Guntur

Financial Independence Retire Early Fire The Motley Fool Social Security The Motley Fool Time Value Of Money

Epf Contribution Rates 1952 2009 Download Table

Epf Contribution For Employee Age Above 60 Blog

Epfo Government Of India Will Pay The Epf Contribution Of Both Employer And Employee 12 Each For The Next Three Months So That Nobody Suffers Due To Loss Of Continuity In

No comments for "epf contribution after 60 years of age"

Post a Comment